Newsletters

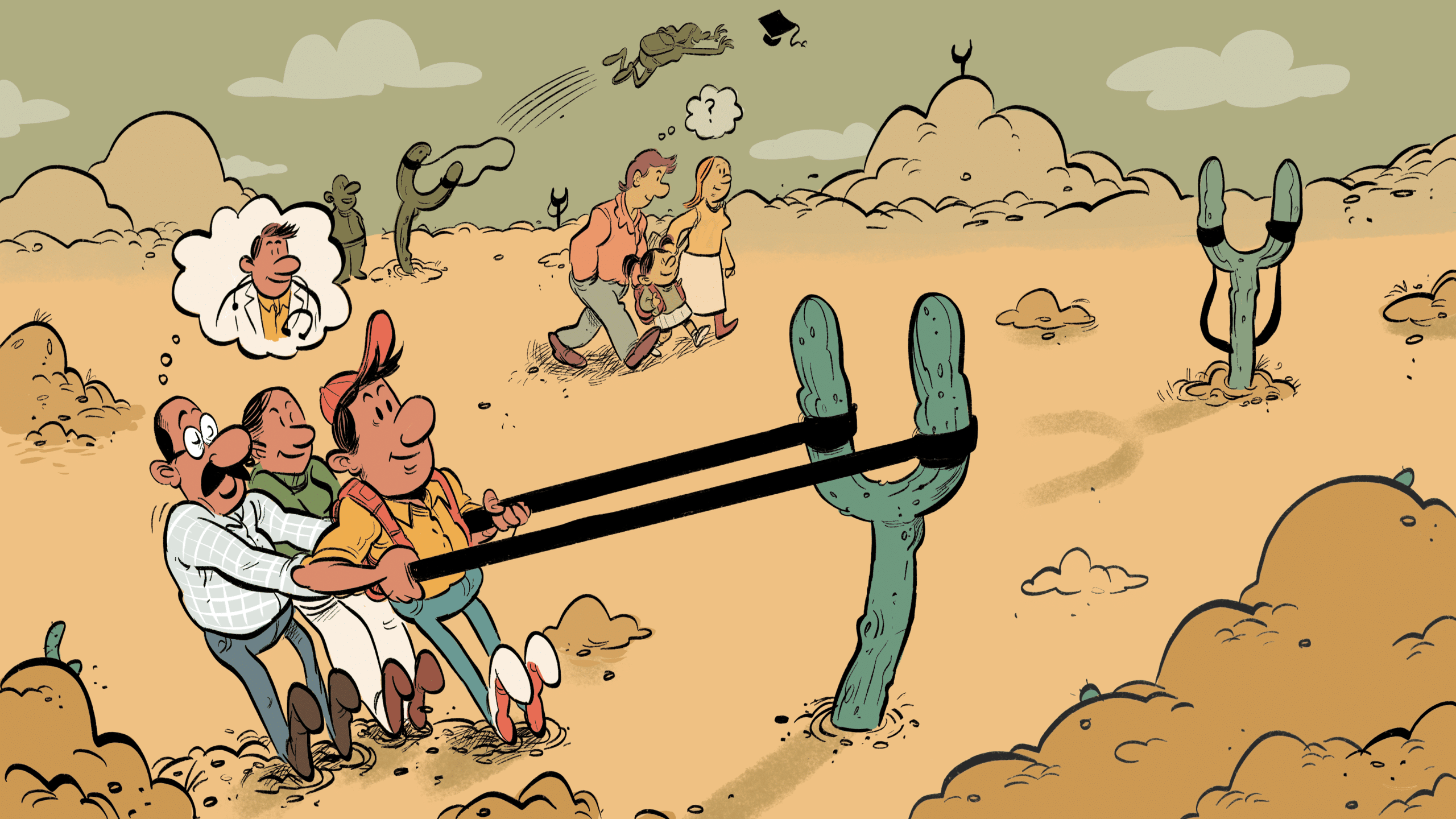

Leaving a lasting legacy for your family can involve careful planning and a team of professionals. Here are five questions that can help get you started.

Stepfamilies are common, but planning for who gets what after you die is anything but routine. When families come together, each with their own possessions, ensuring your assets go where you want is key.

For couples who meet later in life, retirement planning may seem a little daunting. But it doesn’t have to be. If you get started now, and ask the right questions along the way, it can even be exciting. Here are a few questions that should be top of mind.

The Private Giving Foundation was the first-of-its-kind fund in Canada. Jo-Anne Ryan, Executive Director and architect of the foundation speaks to us about the value of flexible giving and how you can make an impact with your good fortune.

When interest rates move lower, you may wonder how your finances will be impacted, both now and in the future. What does it mean for people with mortgages, savers or the recently retired? Nicole Ewing, Director, Tax and Estate Planning, TD Wealth, joins Kim Parlee with some ideas to help manage the changing environment.

A doctor? A lawyer? Maybe a software engineer? Who knows what path your child may pursue. We break down the economics of some popular career paths so you can ask: How can I help?

Many people have heard of the Registered Education Savings Plan (RESP), but not everyone knows how it works. Here are some of the ins and outs of this registered account.

We take pride in delivering personalized advice. To achieve this, we take a 360-view of your present situation to learn more about your vision for the future and develop long-term strategies to help you achieve your objectives, goals, and priorities.

Financial scams and fraud come in many different forms. Sometimes they arrive in the form of a text message, email, or phone call, and often these forms for fraudulent communications are designed to look like they are coming from your bank.

Many people know at least a little about RRSPs. But what about RRIFs? If you’re in or nearing retirement, are you ready to begin the big conversion? Here’s a quick guide to the world of RRIFs.

Raising a family can put all kinds of pressure on your time and money. Here are a few pointers to help you navigate the “crunch,” so you can be better prepared for the future.