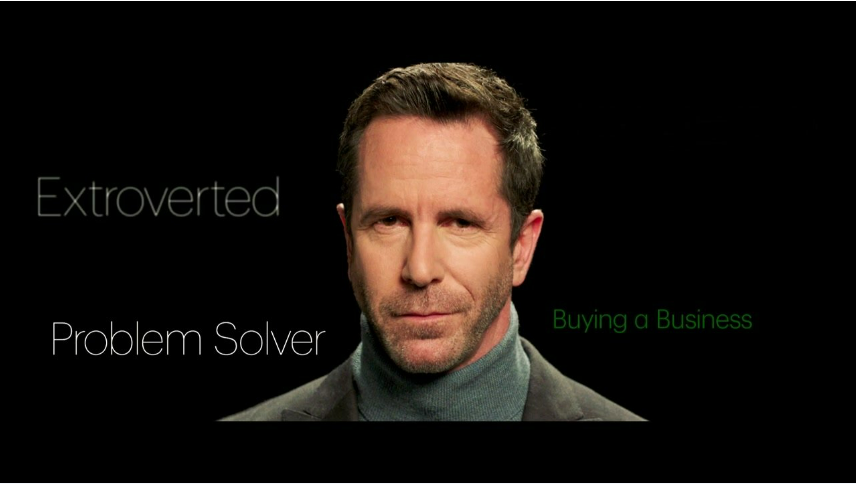

Matt Lawson

Phone

Office Location

Matthew has over 10 years of banking experience starting in retail banking and progressing through more senior roles including branch management. He has an extensive background in Real Estate Secured Lending and Day-to-Day banking. Working with a very experienced team of professionals within TD Wealth, Matthew's goal is to offer you the best advice and recommendations catered to your specific needs.

As a Private Banker with TD Wealth Private Wealth Management, Matthew acts as a knowledgeable resource for a select group of affluent clients and their families. At TD Wealth, we understand that making decisions that affect your life is a deeply personal experience. We also appreciate the key role that growing and preserving your wealth plays in helping you enjoy the life you want to lead. That's why we take a unique approach to understanding you, your family and your values.

Discovering what drives you can drive more in-depth wealth advice

Our distinct discovery process incorporates behavioural finance theory, enabling us to uncover the values behind your goals, identify your priorities and potential blind spots, then create a wealth strategy that's as unique as you are.

Working with a dedicated TD Wealth relationship manager, you'll be connected to a core team of TD specialists with experience ranging from investment advice, estate and trust planning and philanthropy, to business succession and tax planning.

Whether your focus is on building for the future, planning for retirement, or leaving a meaningful legacy, we look forward to having the opportunity to meet with you to discuss how we can help you discover and achieve what truly matters to you.

Languages

English

Dedicated To Helping You Achieve Your Vision Of Success

We will help you achieve your vision of success through:

Implementing tax-efficient strategies - you've worked hard to accumulate your wealth and we want to help you to make the most of it. Working closely with you and your tax advisors, we'll create an integrated wealth strategy that will help structure your investment portfolio to help reduce tax exposure while keeping income available as and when you need it.

Protecting what matters most to you - life is filled with uncertainty and that's why we're committed to delivering advice and solutions to help protect the things you value at every life stage. Whether through comprehensive risk strategies or connecting you with a specialist in trusts, estates and other risk mitigation products, we've got the expertise to create a comprehensive plan that's right for you.

Preparing for the legacy you want to leave - you are the architect of your legacy and we can help you with the blueprint. We'll collaborate with you to identify your top priorities, from estate planning and trusts to gifting and philanthropy. Our goal? To help you optimize the transfer of wealth to those who matter most to you.

A Distinct Discovery

To act for another, one must know the other as they know themselves. Starting with a blank page, an inquisitive mind and great deal of empathy, we ask numerous questions to reveal what is truly most important to you, your family and business. Each person's needs are unique and our goal is to offer you the relevant, customized wealth advice you deserve. We can only do that by getting to the heart of what matters most to you. That's why our approach is to understanding what is important to you, your family and your values. We want to discover everything about you, all the things in your life which make up you and your financial DNA.

Your unique goals

You've worked hard to get where you are today. Now's the time to maintain, grow, and protect your net worth. Get tailored advice, solutions, and strategies that can help achieve your goals.

Trending Articles

Stay informed and enhance your investment knowledge with our curated articles on the latest news, strategies and insights.

Let's talk money: A practical guide for families

Article

Let's talk money: A practical guide for families

From timing and tone to setting the stage — here's how to make money conversations a little less awkward.

3 factors to consider when renewing your mortgage

Article

3 factors to consider when renewing your mortgage

For high-net-worth borrowers, mortgage renewal may be less about affordability and more about strategy.

The giving shift: Canadian women leading a new philanthropic era

Article

The giving shift: Canadian women leading a new philanthropic era

The giving power of women is growing by leaps and bounds — Canadian women are giving nearly 3x more than they were a generation ago.